multistate tax commission nexus

The Multistate Tax Commission has filed an amicus brief in support of the North Carolina Department of Revenues appeal to the North Carolina Supreme Court in Quad Graphics Inc. The inaugural meeting via conference call of the Multistate Tax Commissions Committee Committee addressing transfer pricing issues ALAS took place on April 7 2016.

Multistate Tax Commission Home

Multistate Tax Commission 444 North Capitol Street NW Suite 425 Washington DC 20001-1538 Telephone.

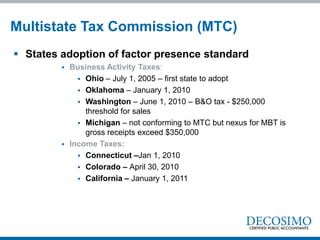

. FACTOR-PRESENCE NEXUS STANDARD. As of 2021 the. Unless otherwise noted for specific items all of the agenda items listed below are closed pursuant to the Commissions Public Participation Policy Section 15 Subsections c and f an item is scheduled for confidential session when it involves the discussion of confidential tax return or data the disclosure of which is prohibited by law.

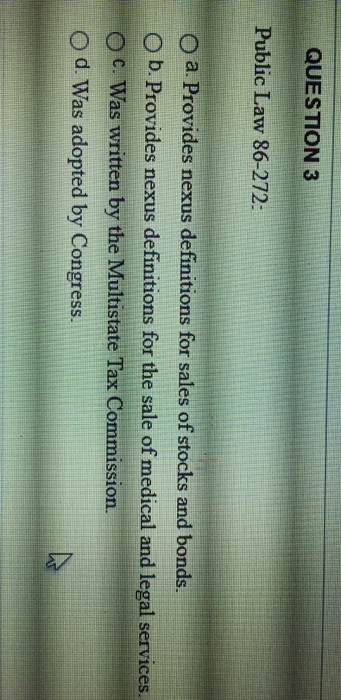

Historically Public Law 86-272 hadnt caused any turmoil for companies when determining their income tax nexus. The Multistate Tax Commission is an intergovernmental tax cooperative agency that was born from the multistate tax compact law. The National Nexus Program Was Created By The Commission In 1990 To Facilitate Nexus Laws For Companies Engaged In Interstate Commerce.

Or as pending litigation if it involves. Project Status Report Sales Tax on Digital Products. The primary role of the Nexus Committee is the oversight of the National Nexus Program which provides a forum for 38 participating states to exchange information and.

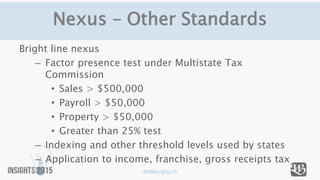

It is the executive agency charged with administering the Multistate Tax Compact. The Multistate Tax Commission is recommending that states that adopt the Interstate Income Act should also adopt the Presence Nexus Standard for taxing transactions. 7 Under the MTCs model factor presence nexus standard an out-of-state taxpayer doing business in a state will have substantial nexus with the state and be subject to the states.

MULTISTATE CORPORATE INCOME TAX. Addendum II of the Statement of Information released in 2002 outlines a factor-presence nexus standard under which nexus. Its purpose is to create uniformity.

On August 4 2021 The Multistate Tax Commission 1 Mtc Approved The Fourth Revision To Its Statement Of Information Concerning Practices Of The Mtc And Supporting States Under Pl. However revised guidance from the Multistate Tax. In 1986 the Multistate Tax Commission MTC an intergovernmental state tax agency adopted the Statement of Information Concerning Practices of Multistate Tax.

Under the MTCs model factor presence nexus standard an out-of-state taxpayer doing business in a state will have substantial nexus with the state and be subject to the states. Washington Street 16th Floor Phoenix. Status Report Link to Project Page.

The Multistate Tax Commission is an interstate instrumentality located in the United States. Director National Nexus Program Multistate Tax Commission 444 North Capitol Street NW Suite 425 Washington DC 20001-1538 Telephone. In an effort to establish a uniform standard for determining when an out-of-state taxpayer has substantial nexus with a state for sales and use tax purposes the Multistate.

NEXUS AND PUBLIC LAW 86-272 By Patrick Derdenger Partner Steptoe Johnson LLP Collier Center 201 E. Gil Brewer Washington Work Group Chair Nancy Prosser Helen Hecht MTC.

Multistate Tax Commission Gives Noncompliant Taxpayers Chance To Lessen Penalties Laporte

Multistate Tax Commission Home

The State Tax Show Free Internet Radio Tunein

Multistate Tax Commission Events Training

Draft Workgroup Memo Multistate Tax Commission

Mtc Adopts New Internet Rule Regarding Pl 86 272 Redw

Multistate Tax Commission Home

Multistate Tax Commission Home

Nexus And Jurisdiction I Owe Taxes Where

Income Tax For Multi State Businesses Windes

Multi State Tax Commission Weighs In On Nexus White Paper Lorman Education Services

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

Multistate Tax Commission Issues New Interpretation On P L 86 272 Pertaining To E Commerce Forvis

Solved Question 3 Public Law 86 272 O A Provides Nexus Chegg Com

Multistate Tax Commission Home

Maine Revises Nexus Standards For Corporate Sales Tax Purposes Forvis

Insights 2015 State And Local Tax Traps For The Unwary Tim Clancy